Tax Loss Harvesting - A Silver Lining

Coming off a difficult year in the financial markets, and looking forward to what is shaping up to be another volatile year, many investors are looking for ways to lighten the blow of their investment losses. While investment losses are never ideal, there may be a silver lining – tax loss harvesting.

Each year as we near the tax filing deadline, it becomes commonplace to think about different strategies for lowering your tax bill. Unfortunately, it is a bit too late to do anything that will benefit your taxes this year, however, it is never too late to start the habit of working with a good tax planner. Taxes are an annual occurrence and even if you haven’t had the best strategy in the past there is no time like the present. One component of a strong tax plan can be the incorporation of tax loss harvesting.

What is tax loss harvesting? Tax loss harvesting is the process of recognizing investment losses, applying the losses against capital gains, and investing the proceeds elsewhere. It can be a useful tool to decrease your tax liability when the dreaded April 15th deadline rolls around. While an in-depth analysis of your situation by a qualified professional is always recommended, there are a few common cases that generally trigger a tax loss harvesting opportunity. Each of the below scenarios assumes that you have losses on some investments in your portfolio.

Large investment gains: Given that we are coming off one of the longest bull markets in history, many people are holding onto positions that may have gained upwards of 1,000%. This is a great problem to have. Now may be a great time to take some of the chips off the table and recognize a portion of the gains.

Getting rid of losers: Though it may be hard to accept, you can’t win them all. Just about every portfolio contains positions that haven’t performed well. While it may seem painful, sometimes the best long-term decision is to get rid of the positions that have been performing poorly.

Rebalancing: Recognizing losses to offset gains can be an effective way to rebalance your portfolio. When one asset class has outperformed or underperformed the others, it naturally leads to your portfolio’s target allocation being out of line. Tax loss harvesting can be a very efficient way to get your portfolio back to its target without creating a large tax burden.

The above situations often open the door to tax savings while keeping funds invested and reaping the benefits of long-term investment growth in the future. If either one of the above situations applies to you, it may be worth a discussion with your financial advisor.

Though tax loss harvesting can be an extremely effective tool, before taking any action there are a few key details that need to be considered.

Firstly, the internal revenue service (IRS), has three different classifications of income. Ordinary income, portfolio income, and passive income. In general, each type of income can only be offset by losses of the same nature, i.e. ordinary income can be offset by ordinary losses, etc. Gains and losses on stocks, bonds, and other investments are classified as portfolio income. Per the above rules, you would only benefit from recognizing portfolio losses up to your recognized portfolio gains in a given tax year. However, there is an exception. Portfolio losses can offset ordinary income up to $3,000 per annum, with any excess losses being carried forward indefinitely into future tax years. Taking an additional $3,000 of ordinary income off the table can result in a decent amount of tax savings. This is the reason the example below uses $53,000 of recognized loss instead of only $50,000.

Secondly, it is important to remember that tax loss harvesting doesn’t save you money dollar for dollar. In other words, recognizing $50,000 of losses doesn’t directly result in $50,000 of savings. These losses simply help offset gains that would have increased your taxable income.

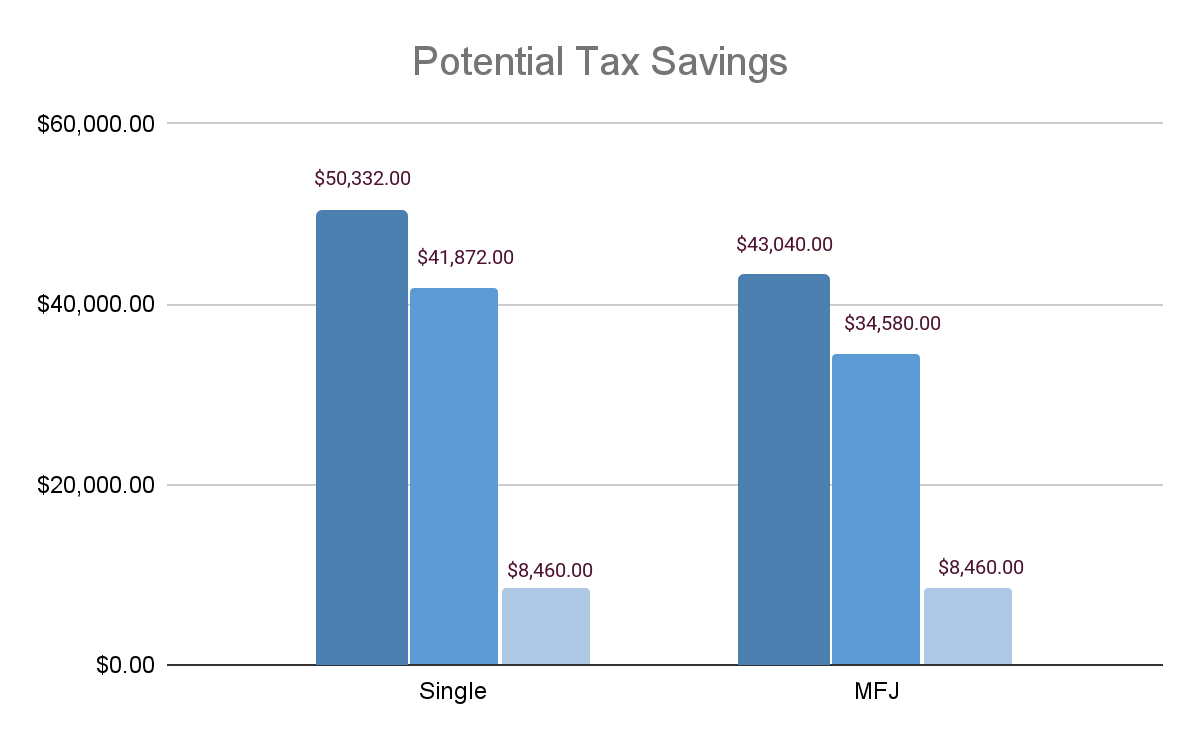

The graph below displays two scenarios of savings based on separate tax filing statuses. Both scenarios are calculated assuming the taxpayer had a taxable income of $200,000 and capital gains of $50,000. The dark blue bar represents the total tax that would be owed without recognizing any losses; the light blue bar next to it represents the total tax that would be owed while taking the maximum amount of losses possible ($53,000) from a tax perspective. The grey-blue bar represents the difference in the two amounts i.e. the potential tax savings.

* The above figure does not consider the standard deduction or any other tax deductions available. The numbers above are for illustrative purposes using 2023 tax brackets and do not represent actual tax calculations.*

As illustrated, recognizing losses of $53,000 would result in federal tax savings of $8,460 plus any additional state tax savings. Now, that may not seem like much, but if the proceeds of the losses are invested elsewhere you are still able to reap the benefits of investment growth in the future. In the end, you save $8,460, and from an invested dollars standpoint remain virtually in the same position that you started from.

After all of that, the wash sale rules will need to be considered. If the proceeds of an investment loss are invested in the same or “substantially identical” security within 30 days before or after the sale, a wash sale is triggered and the losses from the sale are disallowed by the IRS. The definition of substantially identical has extreme ambiguity. You will want to ensure that you consult with a qualified advisor to determine whether or not the investment you are moving the funds to won’t trigger a wash sale.

As always, keep in mind that long-term investment performance should not be controlled by short-term tax benefits. Sometimes tax loss harvesting may not be in your best interest. Given the complexity of tax loss harvesting, I recommend meeting with a qualified financial advisor before making any decisions.